I have been looking for ways to make sense of product life cycles in environments where there are no real products as such, but in which offerings are instead tailored to customer needs. Yet, even in such environments, it is not profitable to always start from scratch, so a form of product management needs to exist, even if that management is more concerned with modules, technologies, and general applications than mass produced products.

I have been looking for ways to make sense of product life cycles in environments where there are no real products as such, but in which offerings are instead tailored to customer needs. Yet, even in such environments, it is not profitable to always start from scratch, so a form of product management needs to exist, even if that management is more concerned with modules, technologies, and general applications than mass produced products.

So far, the only model I have found that seems adequate for the purpose is Geoffrey Moore’s category maturity life cycle, which he presents in his book Dealing with Darwin: How Great Companies Innovate at Every Phase of Their Evolution.

In this post, I will examine this model.

Technology-adoption life cycle

The start of the category maturity life cycle is a sub-model of its own, the technology-adoption life cycle, which has been a recurring theme in Moore’s writing since its introduction in his classic book Crossing the Chasm (1991, revised 3rd edition in 2014).

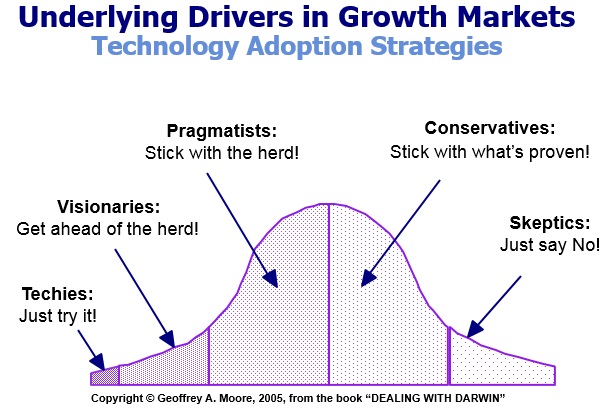

The technology-adoption life cycle is based on the various attitudes people have for new innovations (which can also change innovation by innovation for an individual person): some people are enthusiastic about trying out the new innovation straight away, others want to get ahead of the majority, still others want to be part of the majority, and some would rather never use the new innovation if given a choice.

Thus, Moore divides the technology-adoption life cycle into multiple phases:

Early market. The enthusiasts and visionaries are excited by a new disruptive innovation and begin applying it. As they create applications, the innovation receives attention from the media and the hype begins. However, at this point there is not yet conclusive evidence whether the innovation will really take off.

The chasm. The major challenge for a new innovation is the phase when the media attention is winding down, but the pragmatists have not yet decided whether the innovation is useful. According to Moore, the only way to cross the chasm is to find niche markets of pragmatists, who share a common problem but do not have a viable solution. Only by convincing such a niche of the value of an innovation, can the innovation cross the chasm.

Bowling alley. Once it has crossed the chasm, an innovation starts to spread from one niche market to another. This phase is like bowling: the niche markets are the bowling pins, and as more and more of them adopt the innovation, they tip over an increasing number of other markets.

Tornado. The innovation has proven itself, and a “killer app” of mass market appeal has surfaced. The innovation is now perceived as necessary and standard, and a huge investor gold rush and explosive market growth begin.

Main street. The explosive phase of the market growth ends, and customers have found their vendors of choice. Market shares have largely been determined, and may stay similar for an extended period of time. The technology-adoption life cycle comes to an end once the innovation is completely commonplace. However, the overall market is still a growth market! At this point, the next phase in the overall category maturity life cycle begins.

Category maturity life cycle

The technology-adoption life cycle constitutes just the beginning of the entire category maturity life cycle. Before the end of life of the innovation, there is plenty more to come.

Growth market. The growth market period is a happy time to be a manager: growth can still come in double-digit rates and the risks are low.

Mature market. Category growth flattens out, and real competition begins. Market shares are fought over and more creative attempts to expand the offerings are needed to increase the yields from the available customer space. A key feature of this phase is that it can last indefinitely! Only a new disruptive innovation can trigger a move forward from this phase, so in some industries it lasts decades or even a century.

Declining market. Opportunities to innovate within the category are very difficult to find, and potential new innovations are on the horizon, although none of them have yet proven themselves (crossed the chasm). Investors are not very interested in the category anymore, as there are slim profits to be expected.

End of life. A new disruptive innovation has proven itself and is in the tornado phase. The category has become obsolete. There are still some profits to be made, but the customer base is inevitably decreasing and eventually the category will end.

Innovation and category maturity life cycle

Things get really interesting when Moore adds the aspect of innovation to his model. According to Moore, there is room for innovation at every phase of the life cycle, but certain types of innovation are better suited for certain life cycle phases.

Furthermore, Moore argues that in order for a company to achieve sufficient differentiation in a market, it has to focus on a limited number of innovation types – otherwise it will remain too close to competitors in everything. It is useful to do some innovation in most categories in order to not let the competition get too far ahead, but it is not useful to attempt to match competition in everything, but instead keep close enough in most things and achieve a clear advantage in a limited number of things.

The factors for choosing innovation types to pursue are:

- The phase of the category maturity life cycle the product is in: Some types of innovation are better suited for certain phases of the life cycle model.

- The capabilities your company has: It makes sense to use your strengths.

- The types of innovation your competitors are pursuing: Copying is not the road to success.

Innovation types

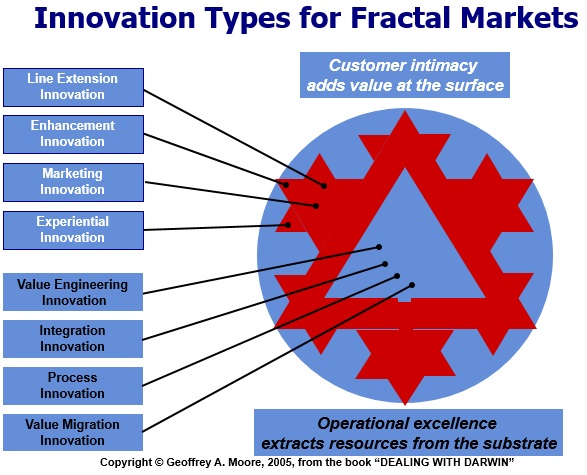

Altogether, Moore lists a total of 14 innovation types divided into four categories: product leadership, customer intimacy, operational excellence, and category renewal. Product leadership innovation is best suited for technology adoption and growth market phases, customer intimacy and operational excellence for mature markets, and category renewal for declining markets and end of life.

Product leadership innovation types

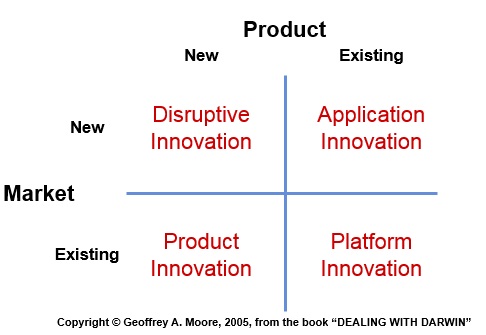

Disruptive innovation. Innovation that creates new market categories either based on new technologies or new business models. This type of innovation creates a brand new market.

Application innovation. Development of new markets and new uses for existing products.

Product innovation. Development of new features and functions for existing products on existing markets.

Platform innovation. Positioning an existing product to take a new role in the market. An example of this is Microsoft and Intel repositioning MS-DOS and the 8086 microprocessor from components of IBM PC to platforms for PC clones.

Customer intimacy innovation types

Line-extension innovation. Modifying an existing offering to create a new subcategory, either to reach a new group of customers or to re-engage an existing group. The introduction of the SUV category in the automotive sector is an example of this.

Enhancement innovation. Modifying an existing offering in a single dimension to re-engage existing customers. The addition of navigation systems to cars is an example of this.

Marketing innovation. Differentiating the interaction with potential customers in order to outsell competitors instead of differentiating through features. Viral marketing is an example of this.

Experiental innovation. Instead of changing the functionality of the product, this type of innovation is about changing the customer experience. A restaurant with a special ambience even though the food is not that different would be an example of this.

Operational excellence innovation types

Value-engineering innovation. Improving the cost-value ratio of the product either by reducing production costs without changing the external properties or by adding value at a relatively low cost (in combination with customer intimacy innovation – note that the general value engineering concept is wider than Moore’s version, in which new features are not part of value engineering as such but a part of customer intimacy instead).

Integration innovation. Integrating separate elements into a single offering. All-in-one printers are an example of this.

Process innovation. Improving profit margins by eliminating waste from the production processes.

Value migration innovation. Redirecting the business model away from commoditizing elements toward elements with higher margins. The printer manufacturers’ switch of focus from the printers themselves to toner cartridges is an example of this.

Category renewal innovation types

Organic innovation. Using internal company resources to reposition the company into a new growth category.

Acquisition innovation. Repositioning the company through merger or acquisition: either by acquiring a share of a growth market, or by selling the company to a new owner who can help the existing product to succeed or use the company resources in a growth category.

Conclusions

Moore has been developing various parts of his model for more than 20 years, and it has grown into a robust and useful tool for analyzing product category and technology life cycles.

Even though there is no conclusive evidence in favor of his claims regarding the importance of focusing only on a single type of innovation per product at a time (and he himself partially contradicts this point by emphasizing the importance of keeping up to the standard level in all categories), nor for his claims on the suitability of innovation types per life cycle phase, the model can nonetheless serve as a useful tool both in reminding us of the finity of life of any innovation and of the wide variety of innovation types available to modify its success.

Already the simple act of consciously recognizing what kind of innovation we are pursuing for each product at a point of time can help focus our efforts more effectively, and thus create better products that are also more profitable.

(All graphics are from Moore’s Dealing with Darwin website)